Crypto Chart Patterns

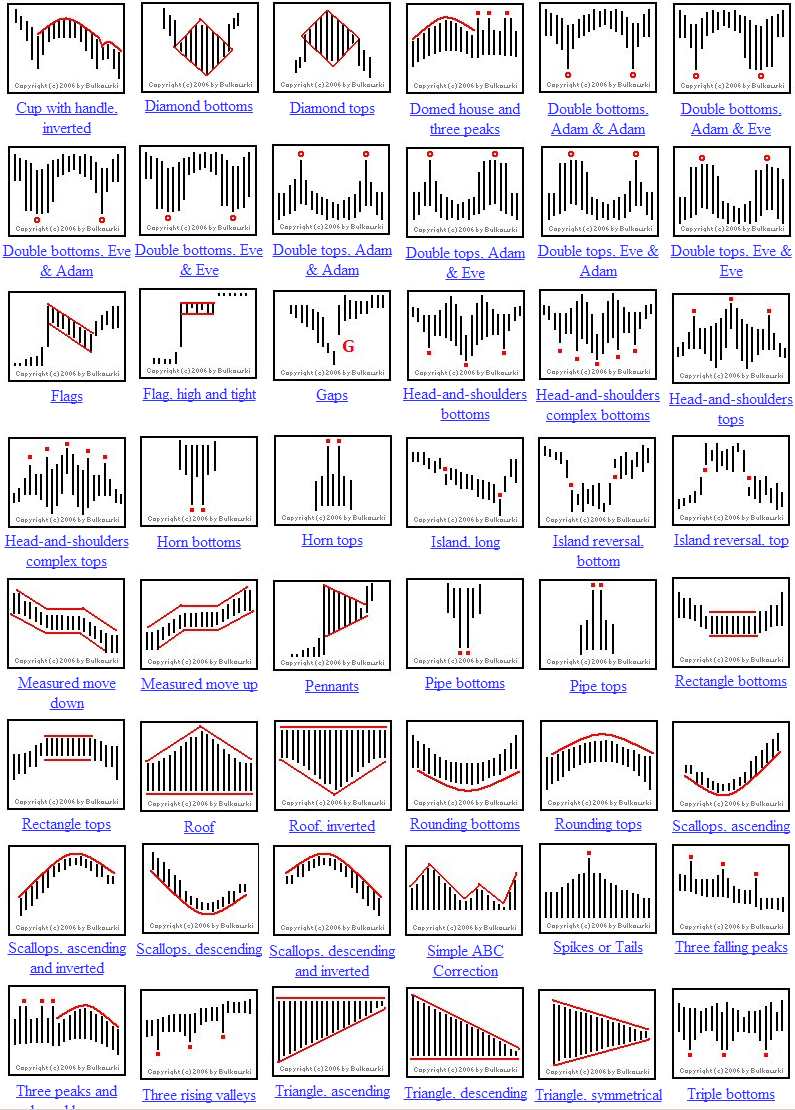

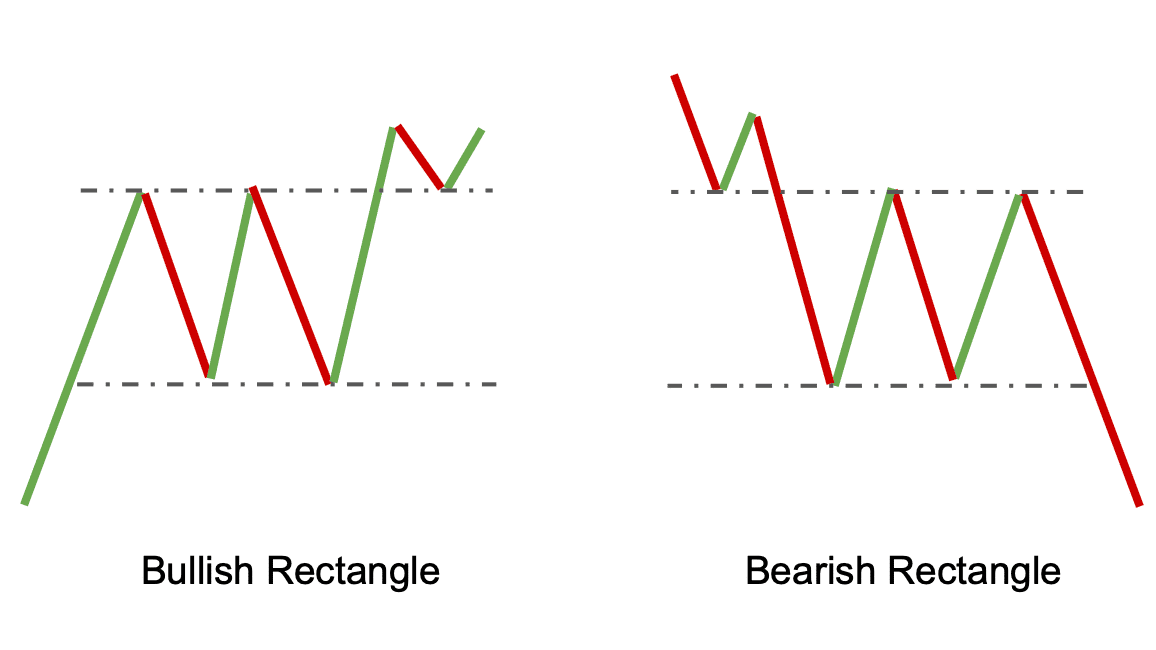

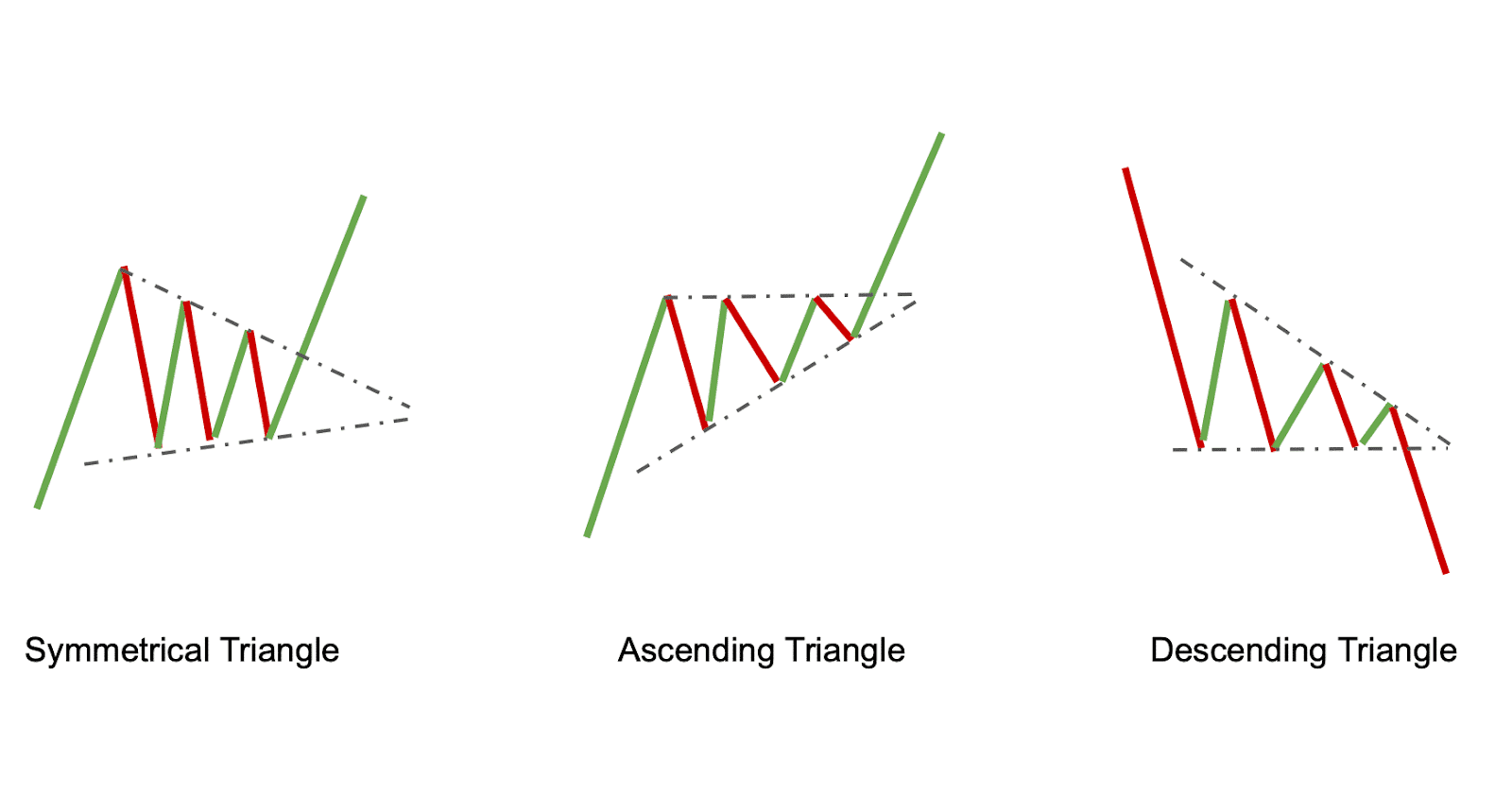

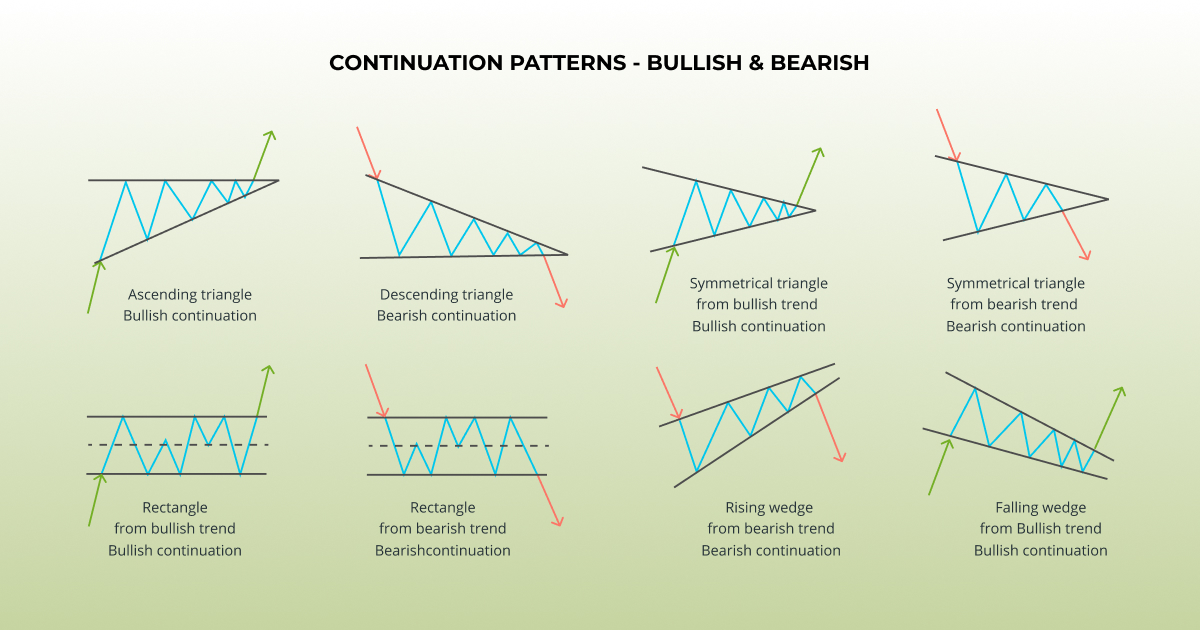

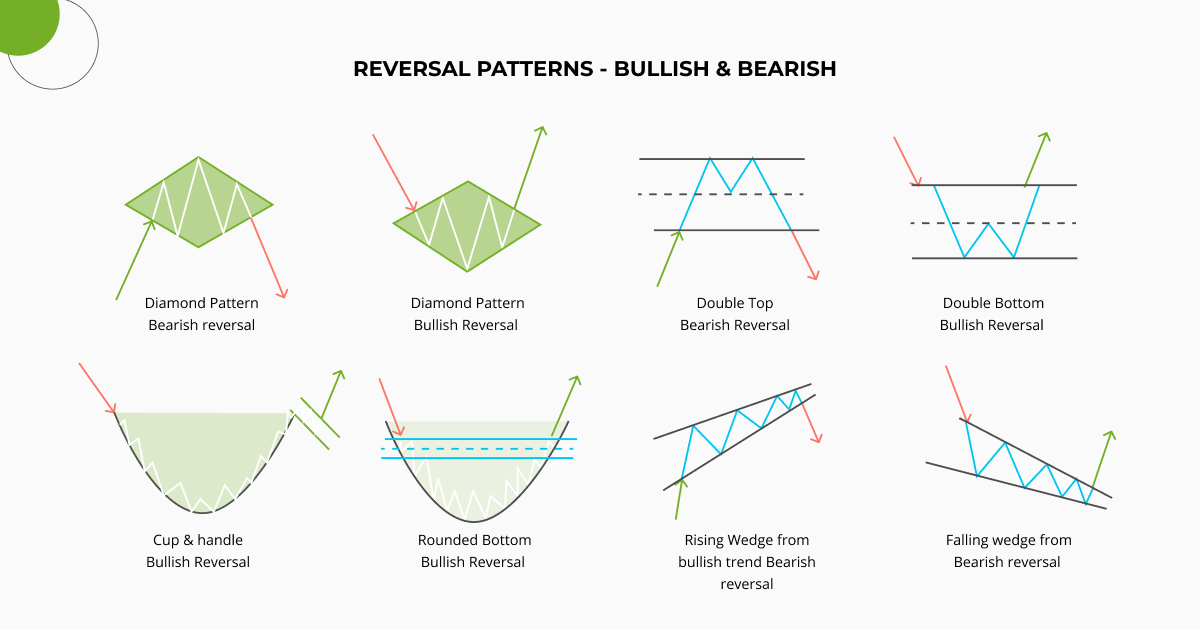

Crypto Chart Patterns - Web candlestick charts are a popular tool used in technical analysis to identify potential buying and selling opportunities. These patterns emerge from collective trader interactions, offering insights into future market trends and directions. Below are three examples to help you. Web learn to spot flags, pennants, wedges and sideways trends and understand how those patterns can inform trading decisions. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. Head and shoulders, inverse head and shoulders. Triangle rectangle, pole and exotic chart patterns. Cryptocurrency chart patterns visually represent historical price movements in the cryptocurrency market. Web in this guide, we will break down these chart patterns into four categories: Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. These patterns emerge from collective trader interactions, offering insights into future market trends and directions. Web learn to spot flags, pennants, wedges and sideways trends and understand how those patterns can inform trading decisions. Web top 20 most common crypto chart patterns, what they mean & downloadable pdf cheat sheet (included). Altfins’ automated chart pattern recognition engine identifies 26 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving traders a ton of time, including: This guide will dive into some of the best crypto chart patterns that can be used by experienced traders and beginners alike. These patterns can indicate potential price movements. Web in this guide, we will break down these chart patterns into four categories: Head and shoulders, inverse head and shoulders. Candlestick patterns such as the hammer, bullish harami, hanging man, shooting star, and doji can help traders identify potential trend reversals or confirm existing trends. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. Web chart patterns are formations that appear on the price charts of cryptocurrencies and represent the battle between buyers and sellers. Web in this guide, we will break down these chart patterns into four categories: These patterns emerge from collective trader interactions, offering insights into future market trends and directions. Due to some chart patterns signaling different things depending on. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. Web crypto chart patterns are recognizable forms or shapes on a cryptocurrency’s price graph that traders use to study market psychology and predict the likelihood of future movements. Web candlestick charts are a popular tool used in. Triangle rectangle, pole and exotic chart patterns. Web in this guide, we will break down these chart patterns into four categories: Web crypto chart patterns are recognizable forms or shapes on a cryptocurrency’s price graph that traders use to study market psychology and predict the likelihood of future movements. Web learn to spot flags, pennants, wedges and sideways trends and. Web candlestick charts are a popular tool used in technical analysis to identify potential buying and selling opportunities. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. Web in this guide, we will break down these chart patterns into four categories: Web what are cryptocurrency chart patterns? Web the better you become. This guide will dive into some of the best crypto chart patterns that can be used by experienced traders and beginners alike. Altfins’ automated chart pattern recognition engine identifies 26 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving traders a ton of time, including: These patterns emerge from collective trader interactions, offering insights into future market. This guide will dive into some of the best crypto chart patterns that can be used by experienced traders and beginners alike. Below are three examples to help you. Web candlestick charts are a popular tool used in technical analysis to identify potential buying and selling opportunities. Head and shoulders, inverse head and shoulders. These patterns can indicate potential price. Below are three examples to help you. Web while reading chart patterns may seem daunting for crypto newcomers, they are integral to any good trading strategy. Web chart patterns are formations that appear on the price charts of cryptocurrencies and represent the battle between buyers and sellers. These patterns can indicate potential price movements. Triangle rectangle, pole and exotic chart. Web what are cryptocurrency chart patterns? Candlestick patterns such as the hammer, bullish harami, hanging man, shooting star, and doji can help traders identify potential trend reversals or confirm existing trends. Web in this guide, we will break down these chart patterns into four categories: Triangle rectangle, pole and exotic chart patterns. Web chart patterns are formations that appear on. Web chart patterns are formations that appear on the price charts of cryptocurrencies and represent the battle between buyers and sellers. Web while reading chart patterns may seem daunting for crypto newcomers, they are integral to any good trading strategy. Head and shoulders, inverse head and shoulders. Cryptocurrency chart patterns visually represent historical price movements in the cryptocurrency market. Familiarize. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. Web what are cryptocurrency chart patterns? Triangle rectangle, pole and exotic chart patterns. Web learn to spot flags, pennants, wedges and sideways trends and understand how those patterns can inform trading decisions. These patterns emerge from collective. Candlestick patterns such as the hammer, bullish harami, hanging man, shooting star, and doji can help traders identify potential trend reversals or confirm existing trends. These patterns emerge from collective trader interactions, offering insights into future market trends and directions. Web candlestick charts are a popular tool used in technical analysis to identify potential buying and selling opportunities. Web top 20 most common crypto chart patterns, what they mean & downloadable pdf cheat sheet (included). Triangle rectangle, pole and exotic chart patterns. Web crypto chart patterns are recognizable forms or shapes on a cryptocurrency’s price graph that traders use to study market psychology and predict the likelihood of future movements. This guide will dive into some of the best crypto chart patterns that can be used by experienced traders and beginners alike. Due to some chart patterns signaling different things depending on when they occur, there are multiple entries for the same stock chart patterns. Web what are cryptocurrency chart patterns? Web while reading chart patterns may seem daunting for crypto newcomers, they are integral to any good trading strategy. Web in this guide, we will break down these chart patterns into four categories: These patterns can indicate potential price movements. Below are three examples to help you. Cryptocurrency chart patterns visually represent historical price movements in the cryptocurrency market. Familiarize yourself with the most common patterns, like head and shoulders, cup and handle, flags, and triangles. Head and shoulders, inverse head and shoulders.Chart Styles in Crypto Trading Crypto Radio

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Crypto Trading Patterns Cheat Sheet Cryptheory Just Crypto

Top Chart Patterns For Crypto Trading

Top Chart Patterns For Crypto Trading Nomad Abhi Travel

Chart Patterns Cheat Sheet r/CryptoMarkets

Chart Patterns for Crypto Trading. Trading Patterns Explained (2022)

Crypto Chart Pattern Explanation (Downloadable PDF)

Chart Patterns for Crypto Trading. Crypto Chart Patterns Explained

Continuation Patterns in Crypto Charts Understand the Basics

Altfins’ Automated Chart Pattern Recognition Engine Identifies 26 Trading Patterns Across Multiple Time Intervals (15 Min, 1H, 4H, 1D), Saving Traders A Ton Of Time, Including:

Web Chart Patterns Are Formations That Appear On The Price Charts Of Cryptocurrencies And Represent The Battle Between Buyers And Sellers.

Web The Better You Become At Spotting These Patterns, The More Accurate Your Trades Develop, With The Added Ability To Dismiss False Breakouts As They Appear.

Web Learn To Spot Flags, Pennants, Wedges And Sideways Trends And Understand How Those Patterns Can Inform Trading Decisions.

Related Post: