Corporate Ownership Chart

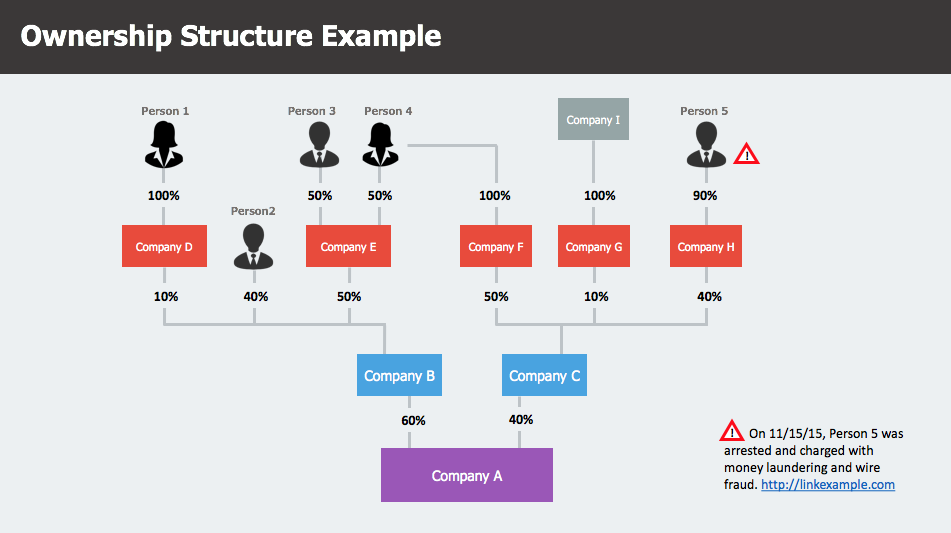

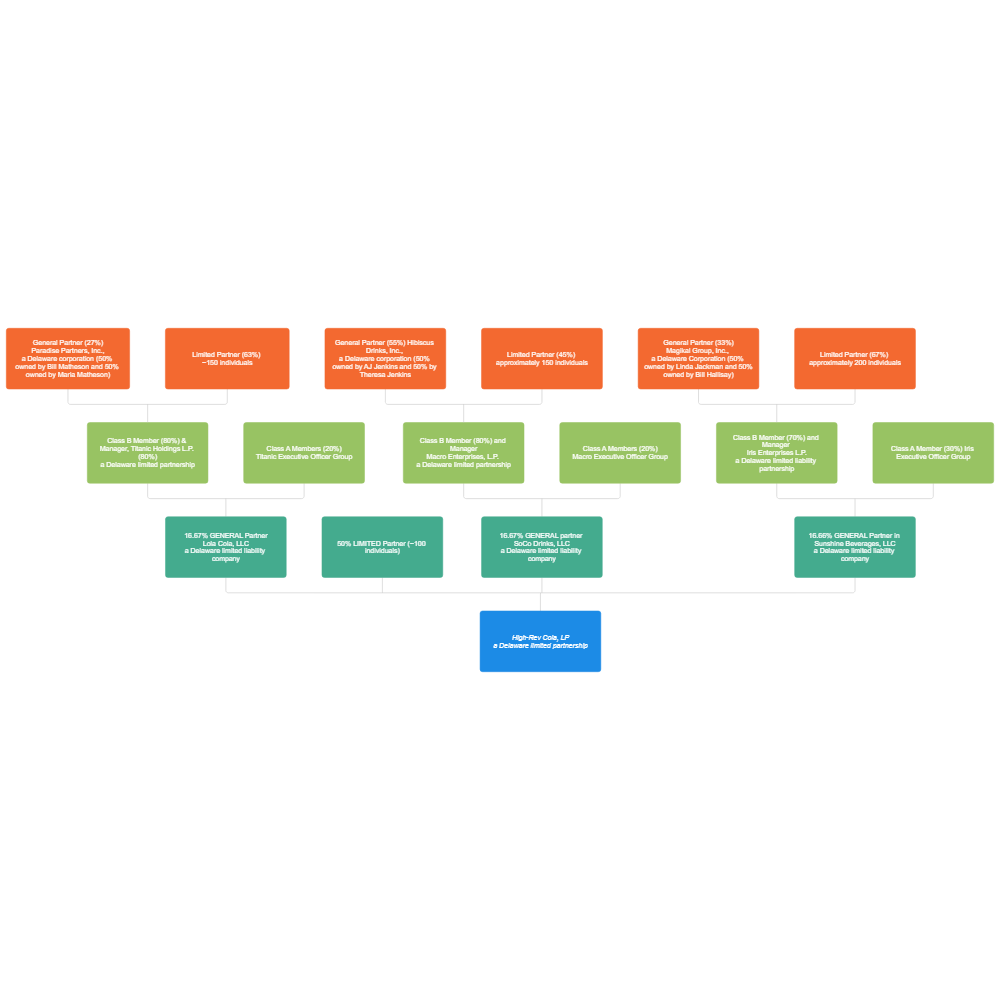

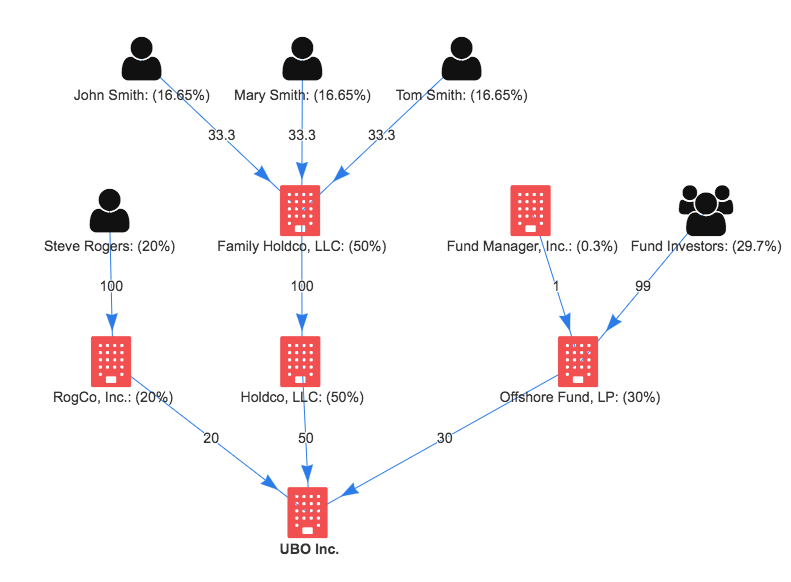

Corporate Ownership Chart - Learn more about them with examples to help. Web when starting a business, there are different types of business ownership structures that you can choose from. Web this template describes a hypothetical ownership structure hierarchy chart. Web compare the general traits of these business structures, but remember that ownership rules, liability, taxes, and filing requirements for each business structure can vary by state. Web make corporate structure vivid. Web there are three types of company hierarchy charts: Web an ownership structure concerns the internal organization of a business entity and the rights and duties of the individual holding the equitable or legal interest in that business. Company ownership charts, governance charts, and; Show ownership connections, legal entity types, and management. A company ownership chart shows the financial and voting interests, among other attributes, for an enterprise. Learn more about them with examples to help. Show ownership connections, legal entity types, and management. For instance, a shareholder who is also the owner of a corporation has certain rights. A company ownership chart shows the financial and voting interests, among other attributes, for an enterprise. Company ownership charts, governance charts, and; The following table is intended only as a guideline. There are several types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. Web an ownership structure concerns the internal organization of a business entity and the rights and duties of the individual holding the equitable or legal interest in that business. Each has its pros and cons, usually dealing with tax structures and liability. When two or more people start a business together, they can form a partnership. With a few simple clicks you can tailor it to suit your business, giving you a chart you'll be proud to present. Web an ownership structure concerns the internal organization of a business entity and the rights and duties of the individual holding the equitable or legal interest in that business. Web make corporate structure vivid. There are several types. Web make corporate structure vivid. Web compare the general traits of these business structures, but remember that ownership rules, liability, taxes, and filing requirements for each business structure can vary by state. They show the relationships between the corporation, its shareholders, and its various classes of stock. The types of legal entities on the chart are important. With a few. They show the relationships between the corporation, its shareholders, and its various classes of stock. There are several types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. Learn more about them with examples to help. Web make corporate structure vivid. The following table is intended only as a guideline. When two or more people start a business together, they can form a partnership. They show the relationships between the corporation, its shareholders, and its various classes of stock. Web when starting a business, there are different types of business ownership structures that you can choose from. The following table is intended only as a guideline. Web organizational charts for. Give them a professional looking chart by starting with this business ownership chart template. Web when starting a business, there are different types of business ownership structures that you can choose from. Web compare the general traits of these business structures, but remember that ownership rules, liability, taxes, and filing requirements for each business structure can vary by state. The. Web an ownership structure concerns the internal organization of a business entity and the rights and duties of the individual holding the equitable or legal interest in that business. In addition, joint ventures have some aspects of partnerships. Web there are three types of company hierarchy charts: The types of legal entities on the chart are important. When two or. Show ownership connections, legal entity types, and management. Web there are three types of company hierarchy charts: For instance, a shareholder who is also the owner of a corporation has certain rights. Give them a professional looking chart by starting with this business ownership chart template. Web make corporate structure vivid. Web make corporate structure vivid. The types of legal entities on the chart are important. With a few simple clicks you can tailor it to suit your business, giving you a chart you'll be proud to present. The following table is intended only as a guideline. Company ownership charts, governance charts, and; With a few simple clicks you can tailor it to suit your business, giving you a chart you'll be proud to present. Web there are three types of company hierarchy charts: The following table is intended only as a guideline. Investors, bankers, lenders, insurers and many others will ask to see a chart of your business ownership structure. Web an. With a few simple clicks you can tailor it to suit your business, giving you a chart you'll be proud to present. There are several types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. A company ownership chart shows the financial and voting interests, among other attributes, for an enterprise. In addition, joint ventures have some aspects. Company ownership charts, governance charts, and; Show ownership connections, legal entity types, and management. Web there are three types of company hierarchy charts: Investors, bankers, lenders, insurers and many others will ask to see a chart of your business ownership structure. They show the relationships between the corporation, its shareholders, and its various classes of stock. Give them a professional looking chart by starting with this business ownership chart template. Web make corporate structure vivid. Learn more about them with examples to help. Web when starting a business, there are different types of business ownership structures that you can choose from. Web an ownership structure concerns the internal organization of a business entity and the rights and duties of the individual holding the equitable or legal interest in that business. Web corporate structure charts are visual representations of a corporation's ownership hierarchy. The types of legal entities on the chart are important. Web compare the general traits of these business structures, but remember that ownership rules, liability, taxes, and filing requirements for each business structure can vary by state. Web organizational charts for business are used by compliance teams to group subsidiaries by function to reveal entity's ownership structure. The following table is intended only as a guideline. Each has its pros and cons, usually dealing with tax structures and liability.Entity Ownership Structure Chart

Business Ownership Chart

Corporate Org Chart Diagram Structure Ownership 库存插图 153897818

Organizational Ownership Structure With Share Holders PowerPoint

Ownership Structure Template

Business Ownership Chart

Ownership Structure Chart Template

Ownership Chart Now Available in Entity Management Tool

Diagram of Company's Ultimate Beneficial Owners (UBO) and Shareholder

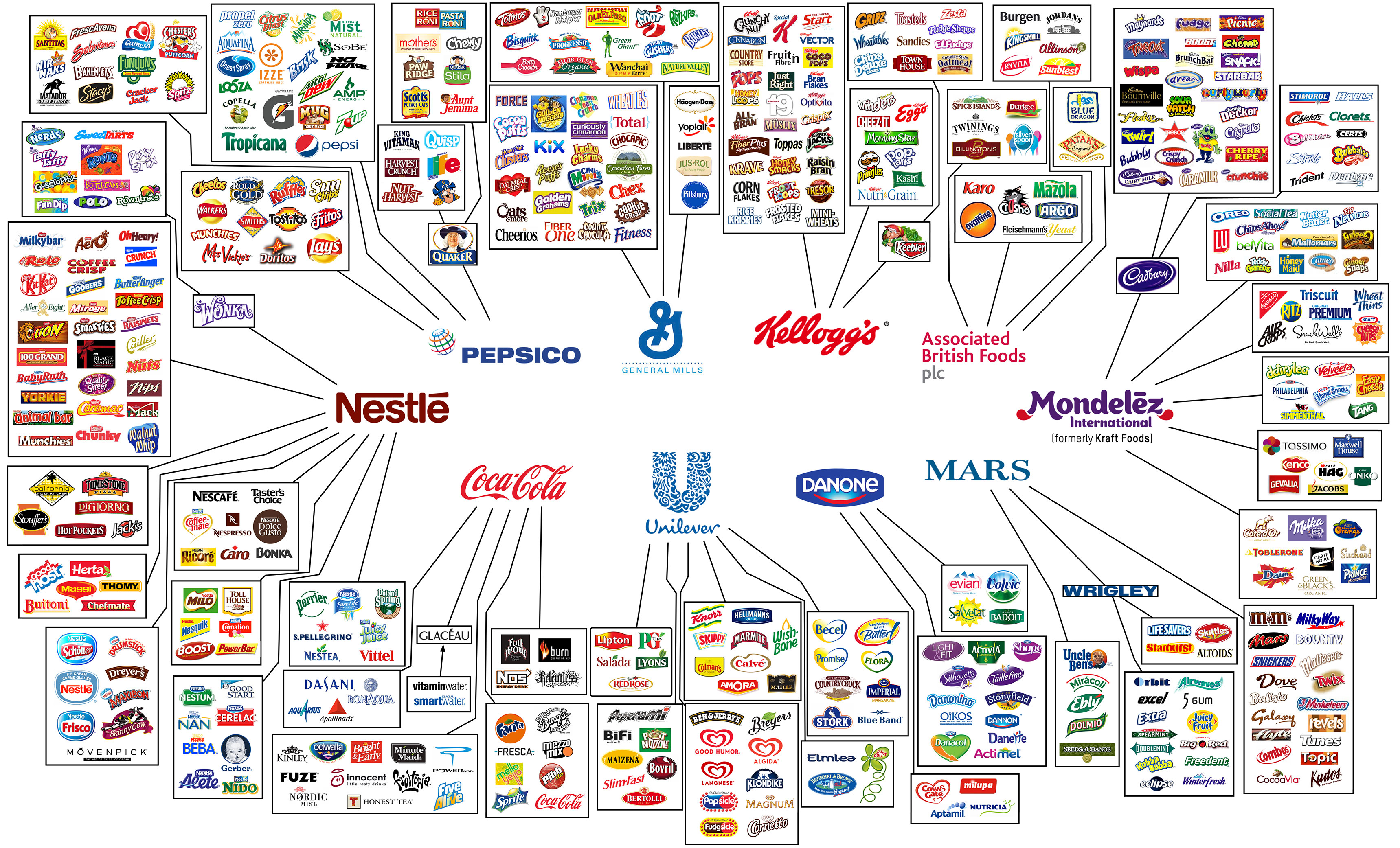

Brand Ownership Infographic Ivan Teh RunningMan

For Instance, A Shareholder Who Is Also The Owner Of A Corporation Has Certain Rights.

With A Few Simple Clicks You Can Tailor It To Suit Your Business, Giving You A Chart You'll Be Proud To Present.

When Two Or More People Start A Business Together, They Can Form A Partnership.

In Addition, Joint Ventures Have Some Aspects Of Partnerships.

Related Post: